Federal Tax Credits & Childcare FSAs (2025 Update)

A tax credit is a valuable tool for families, offering a dollar-for-dollar reduction in the taxes owed. Some credits are even refundable, reducing taxes to zero and providing a refund. The American Rescue Plan Act of 2021 has enhanced the benefits for families with children, specifically for child care. Here's a breakdown:

Child Tax Credit (CTC)

Eligible families can claim up to $2,000 per child, with $1,700 refundable. Learn more at the IRS Child Tax Credit page

Child & Dependent Care Tax Credit

Get back up to 35% of qualifying childcare expenses—up to $3,000 per child or $6,000 per household. Learn more here

Dependent Care FSA (Flexible Spending Account)

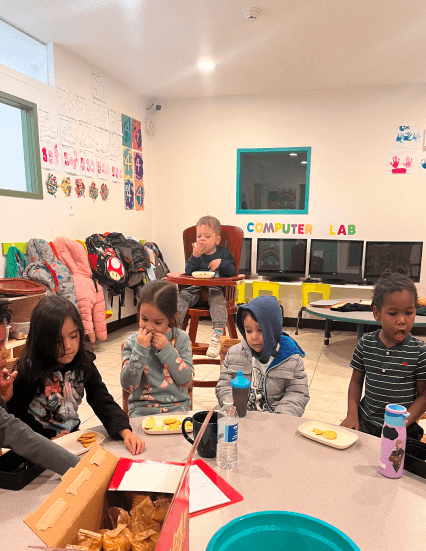

In 2025, you can contribute up to $5,000 tax-free through your employer to cover daycare tuition, including at Learning Space Christian Academy.

Earned Income Tax Credit (EITC)

The Earned Income Tax Credit (EITC) provides a tax break for low- to moderate-income workers and families. If you qualify, this credit can help reduce the amount of tax you owe and may even increase your refund. Learn more at the IRS Earned Income Tax Credit page